Investing in gold through an Individual Retirement Account (IRA) is a strategic way to diversify your retirement portfolio and hedge against economic uncertainties. Physical gold bars, in particular, offer tangible value and have been trusted for centuries as a store of wealth. In this article, we’ll explore some of the best gold bars suitable for IRAs, the benefits of gold investments, and highlight reputable companies that offer these products.

Why Invest in Gold for Your IRA?

Gold has long been a reliable asset for investors looking to secure their wealth. Some of the primary reasons for including gold in your IRA include:

- Hedge Against Inflation: Gold retains value even during times of economic downturn or high inflation rates.

- Portfolio Diversification: Adding gold to your IRA helps balance the risks associated with stocks and bonds.

- Tangible Asset: Unlike stocks or digital investments, gold is a physical asset with intrinsic value.

- Long-Term Stability: Gold has historically maintained or increased in value over long periods.

Understanding IRA-Approved Gold Bars

Not all gold bars are eligible for inclusion in an IRA. The Internal Revenue Service (IRS) has specific requirements:

- Purity: Gold must have a minimum fineness of 99.5%.

- Manufacture: Bars must be produced by a NYMEX or COMEX-approved refinery or a national government mint.

- Form: The gold should be in the form of bars or rounds meeting the above criteria.

It’s essential to purchase these bars from reputable dealers to ensure authenticity and compliance with IRS regulations. Working with a trusted custodian can help ensure that your gold is stored correctly and remains compliant with IRA rules.

Top Gold Bars for IRAs

Here are some of the most popular IRA-approved gold bars:

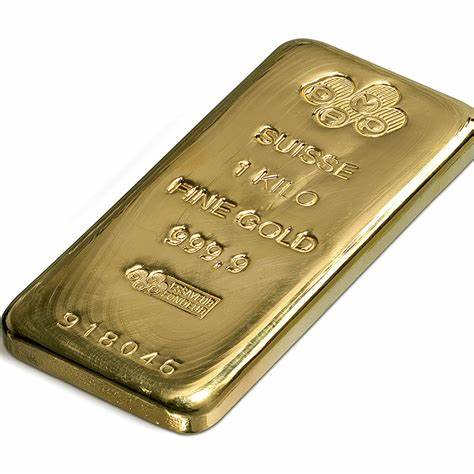

1. PAMP Suisse Gold Bars

PAMP Suisse is renowned for its high-quality gold bars, featuring intricate designs and high purity levels. Their bars come with an assay certificate, ensuring authenticity and purity. Available in various sizes, they cater to different investment needs.

Consider adding PAMP Suisse gold bars to your IRA for a blend of quality and security. Check availability here.

2. Credit Suisse Gold Bars

Produced by the reputable Credit Suisse Group, these gold bars are IRA-approved and come in various sizes, making them a flexible option for investors. Credit Suisse bars are well recognized globally, ensuring liquidity when needed.

Explore Credit Suisse gold bars to diversify your retirement portfolio. Shop now.

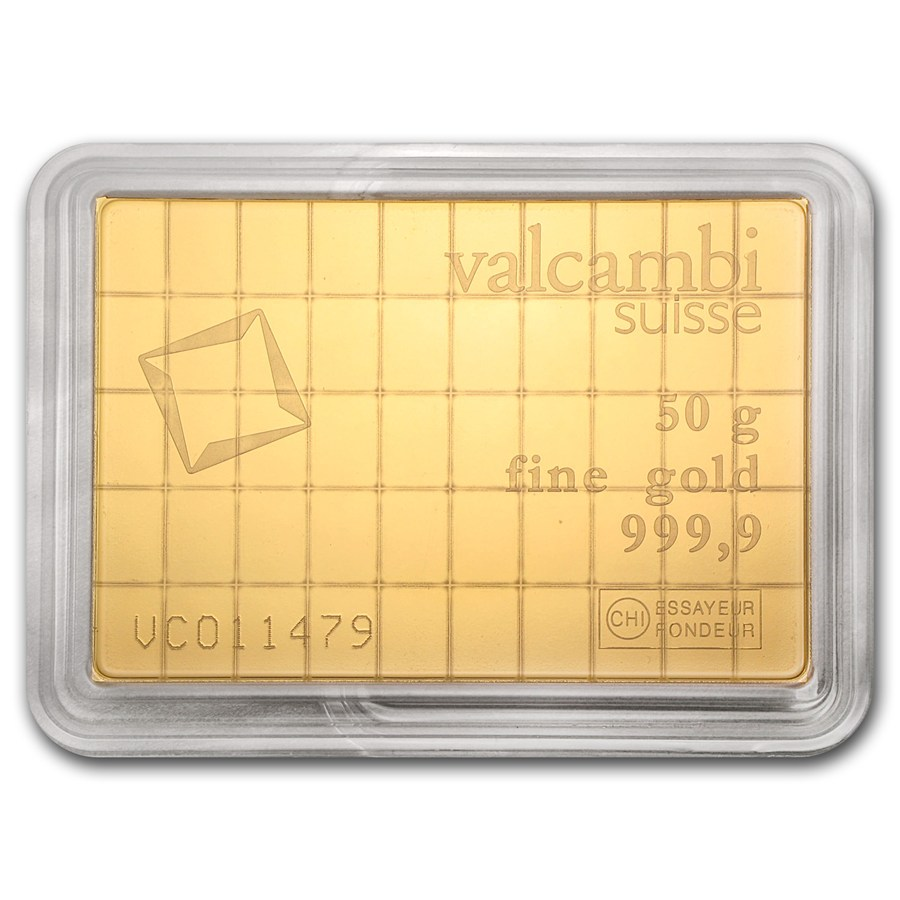

3. Valcambi Gold CombiBar

Valcambi’s CombiBar is unique, allowing investors to break off smaller portions without affecting the bar’s purity or value. This feature offers flexibility in liquidity, making it an attractive option for those who may need to sell portions of their investment over time.

Invest in Valcambi’s CombiBar for versatility within your IRA holdings. Get yours today.

Additional Considerations When Buying Gold for Your IRA

Before investing in gold bars for your IRA, here are a few things to keep in mind:

- Storage Requirements: The IRS mandates that gold in an IRA must be stored in an approved depository.

- Custodian Selection: You will need to work with a trusted IRA custodian to handle the purchase and storage of your gold.

- Market Fluctuations: Although gold is considered stable, its price can fluctuate. Keeping a long-term investment perspective is key.

Reputable Gold IRA Companies

When considering adding gold bars to your IRA, it’s crucial to work with reputable companies that specialize in precious metals IRAs. Here are a few notable ones:

Augusta Precious Metals

Augusta Precious Metals is recognized for its commitment to transparency and customer education. They offer a range of IRA-approved gold bars and have a proven track record in assisting investors with their retirement portfolios. Learn more here.

Partner with Augusta Precious Metals to secure your retirement with high-quality gold bars.

Goldco

Goldco specializes in helping investors diversify their IRAs with precious metals. They offer a variety of IRA-approved gold bars and provide comprehensive support throughout the investment process. Goldco is known for its excellent customer service and educational resources. Join Goldco here.

Secure your financial future by investing in gold bars through Goldco.

Birch Gold Group

Birch Gold Group offers a wide selection of IRA-approved gold bars and is known for its educational approach, helping investors make informed decisions about their retirement assets. Their expert team assists clients throughout the process, ensuring seamless integration of gold into an IRA. Start investing.

Enhance your IRA with premium gold bars from Birch Gold Group.

Frequently Asked Questions About Gold IRAs

Can I Take Physical Possession of My Gold in an IRA?

No, IRS regulations require that IRA-held gold be stored in an approved depository. You cannot take physical possession until you make a distribution, at which point it may be subject to taxes and penalties depending on your age.

What is the Minimum Investment for a Gold IRA?

The minimum investment varies by company, but most firms require an initial investment of at least $10,000 to $25,000.

Are There Fees Associated with a Gold IRA?

Yes, expect fees for setup, storage, and custodial management. Fees vary depending on the provider and the storage option you choose.

Conclusion

Incorporating IRA-approved gold bars into your retirement strategy can provide stability and growth potential. By partnering with reputable companies, you can ensure that your investments meet IRS requirements and align with your financial goals. Additionally, understanding the factors involved in gold investing will help you make informed decisions.

Start diversifying your retirement portfolio today by exploring IRA-approved gold bars from trusted providers. Find your investment now.